Payroll Services

Answer a few questions, and we’ll provide you with experienced payroll solution.

or Login

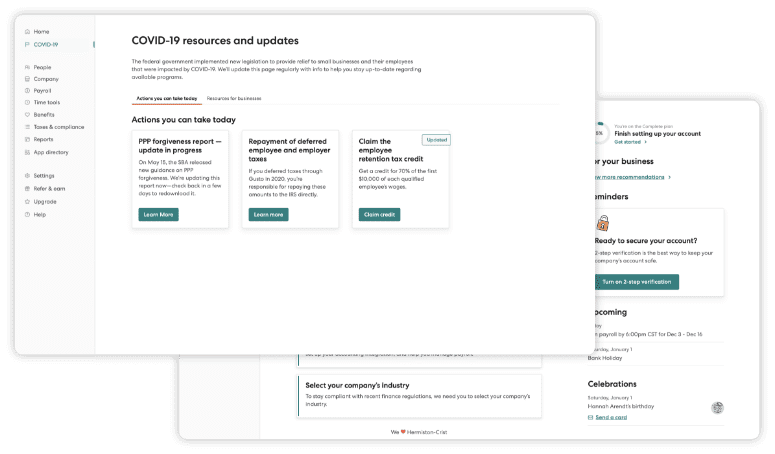

Online Dashboard

Take the hassle out of paydays and get back to growing your business! Our team of experienced professionals work with you to design cost-effective solutions that meet the specific needs of your business today and as it grows.

No more IRS penalties! Did you know that every year 1 out of 3 small businesses pay a penalty to the IRS? With America’s Preferred Payroll, you will never miss a deadline or pay the wrong amount.

Accuracy and convenience that you can count on!

- Guaranteed accurate federal, state, and local tax withholding.

- New direct deposit information processed in 48 hours and hours can be submitted up to 72 hours before payday.

- Employees can opt to deposit into up to 2 accounts, including checking, savings, and investment accounts.

- Employees have access to detailed pay information through online access to their paystubs.

- Our integrated payroll and benefits package provides insightful management reports with detailed salary and wages, taxes, hours worked, vacation and sick time used, labor allocations, total costs, and more – generate custom reports to meet your specific needs.

Our payroll servicing can handle processing any type of pay including:

- Salary, hourly, overtime, shift differentials

- Commissions and bonuses, including reduced withholding rate

- Vacation, sick, holiday, PTO

- Tip reporting

- Cash advances

- Expense reimbursements

- Payments to independent contractors

We Integrate with 1,100+ Popular Softwares

America’s Preferred Payroll dashboard connects with today’s top software.

As for deductions, you can be rest assured that they will be accurately calculated and paid appropriately. Types of deductions can include:

- Taxable and pretax premiums for medical, dental, and vision

- Flexible spending accounts

- Health savings accounts

- 401k, SIMPLE, and other retirement plan contributions

- Group-term life insurance

- Long-term and short-term disability insurance

- Dependent care

- Child support

- Loan repayments

- Wage garnishments deducted and paid to authorities as required

Our payroll system is compatible with:

- QuickBooks®

- QuickBooks Online Edition

- QuickBooks for Mac

- Peachtree®

- ATX Client Write-Up™

- TaxWise Client Write-Up™

- CCH ProSystem fx®

- Microsoft® Money

- Easily export to Microsoft® Excel

- And many more systems

Service Plan

-

- Full-service payroll across all 50 states

- Friendly, experienced payroll support

- Customizable reports

- Flexible PTO policies, accruals, and tracking

- Employee access to payroll debit cards and payday advances

- Employee document management

- Electronic employee self-onboarding, self-service, and lifetime accounts

- Access for your accountant

- Integrated with accounting and time tracking software

Say Goodbye to Payroll Hassles

Answer a few questions, and we’ll help you find the perfect payroll solution.

Federal & State Tax Deposits and Reporting

Did you know that employers have personal liability for unpaid payroll taxes if the required payroll deposits are not made? Let our experienced payroll professionals handle these taxing requirements for you!

- We ensure that all federal, state, and local payroll tax deposits are made on time. Funds remain in your account until payments are due—no advance impounding!

- We prepare, file, and pay all quarterly and annual federal payroll tax returns (Forms 941 and 940).

- We prepare and file W-2 Forms with the Social Security Administration.

- We prepare and file all Forms 1099 with the IRS for independent contractors paid through America’s Preferred Payroll.

- We prepare, file, and pay all quarterly and annual state and local returns, including unemployment returns.

- We stand behind the accuracy of our work with our No Penalty Guarantee. If we make an error in a federal, state, or local tax filing, we pay the penalty and interest.

With all services:

- Checks can be printed with the Owner’s Signature or electronically sent to customers to print and hand-sign checks.

- Tailored Programs to fit your business.

- Pay As You Go workers’ compensation plans are available & supported. You pay accurate work comp premiums each time payroll is run.

- 99% of the Workers’ Compensation Audits are eliminated by our detailed reports.

- 1099s are supported and only the state filing fee is passed onto the customer from the state. No additional fees apply.