Compliance Issues

Laws are ever changing, and it can be difficult to keep up and the consequences for not doing so can be devastating to a company. Reduce the stress of ensuring companywide compliance and leave it to us to handle all aspects of federal and state compliance issues.

There are several aspects of running a business that requires compliance with federal, state, or local laws or regulations. America’s Preferred Payroll Company is here to help you manage compliance issues you may face when handling your company-wide payroll, quarterly and year-end tax filing, new hire paperwork, health and benefits plans, and business insurance plans.

Insurance Compliance

Ensuring compliance in all areas can feel overwhelming – don’t stress, we ensure your company is meeting federal, state, and local requirements for business and health insurance plans. We’ll also handle getting new and current employees enrolled in medical, dental, life, and more. Plus, we will ensure accurate deductions are made from paychecks for their elected benefits.

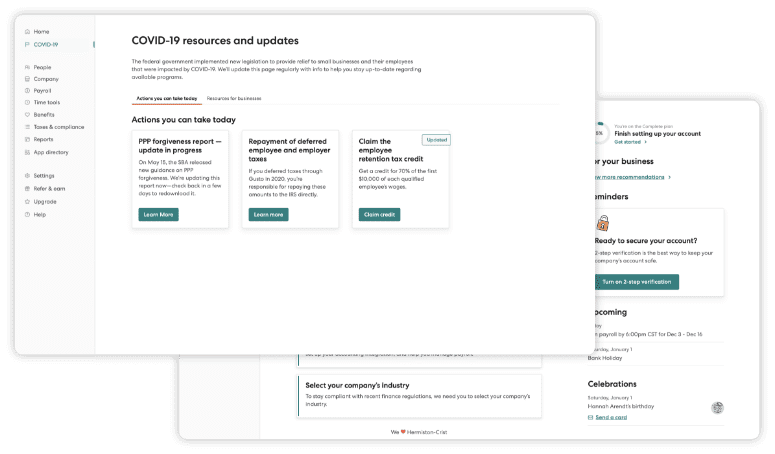

We Integrate with 1,100+ Popular Softwares

America’s Preferred Payroll dashboard connects with today’s top software.

- Full-service payroll across all 50 states

- Friendly, experienced payroll support

- Customizable reports

- Flexible PTO policies, accruals, and tracking

- Employee access to payroll debit cards and payday advances

- Employee document management

- Electronic employee self-onboarding, self-service, and lifetime accounts

- Access for your accountant

- Integrated with accounting and time tracking software

Say Goodbye to Payroll Hassles

Answer a few questions, and we’ll help you find the perfect payroll solution.

Payroll Compliance

With our payroll service, you’ll never miss a tax deadline or pay the wrong amount. We also guaranteed your payroll will be submitted on time and accurately distribute direct deposits for all employees and contractors. As for quarterly and year-end filings, W-2’s, W-4’s, I-9’s and employer registration forms – we do it all! Even when it comes to voluntary deductions – from taxable and pre-tax premiums for medical, dental, and vision to retirement plans and flexible spending accounts. Plus, we’ll help manage child support deductions, cash advance and loan repayments, and others.