Florida Payroll Services

Answer a few questions, and we’ll provide you with experienced HR and payroll solution.

or Login

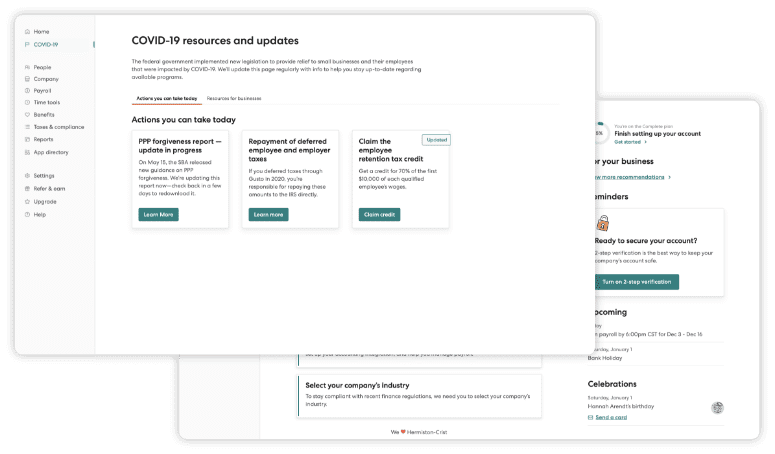

Online Dashboard

There has never been a better time to be an entrepreneur. Launching a company is especially rewarding in business-friendly Florida. The Sunshine State’s laws were written with entrepreneurs in mind. However, most inventors and creative business minds are better suited for product and service development than payroll processing.

If you own or manage a Florida business or are preparing to launch a new company, let our payroll specialists process your payroll. We’ll sweat the small stuff of weekly paychecks, benefits administration, time, attendance, and more while you focus on perfecting your value offering.

Florida Laws Pertaining to Tips

Florida business owners, managers and human resources professionals should also be aware that state law requires that an updated minimum wage poster be displayed in an area of the business that all employees can see. There is even a penalty of $1,000 per violation for intentionally refusing to pay the state’s new minimum wage.

Statewide hospitality business owners and managers should be aware that the state’s tipped minimum wage differs from its minimum wage. Service industry employees, such as those who work in restaurants, are eligible for tips. The state’s tipped minimum wage is $7.98 per hour.

Florida employers are legally empowered to take $3.02 per hour of tip credits. Translated from bureaucratic legalese, this means statewide employers are empowered to pay those who earn tips slightly more than $3 less than the minimum wage. However, the caveat is that hourly earnings with tips added must be a minimum of $11.

Florida employment law also allows for the pooling of tips, be it mandatory or voluntary. The law states there is the potential to require that employees combine their tips for distribution across the entirety of the work crew. However, Florida employers that require tip pooling are legally required to provide advanced notice of the policy to all new hires and current employees.

Statewide employers are barred from forcing employees to combine individual tips into a shared pool if such sharing results in hourly compensation that is less than the aforementioned minimum wage. Moreover, Florida employment law states pool tips cannot be shared with employees who are not eligible for tips. As an example, those who work as restaurant managers are not eligible for a cut of pooled tips earned by waitstaff, cooks, bussers, etc.

Overtime Pay

Florida does not have laws on the books addressing overtime compensation. However, the nationwide overtime law is applicable in Florida. Employees considered to be “non-exempt,” as defined by the FLSA are legally entitled to overtime compensation.

We Integrate with 1,100+ Popular Softwares

America’s Preferred Payroll dashboard connects with today’s top software.

Accurate Payroll on the First Try

Chances are your business has made at least one payroll mistake in the past. Oftentimes, Florida business owners ask employees to multitask, donning several metaphorical workplace hats.

As an example, it is common for businesses to ask administrators to process payroll, answer the phone, greet visitors, and perform data entry. However, few administrators are prepared for the challenge of payroll.

Instead of running the risk of inaccurate employee compensation, inaccurate wage garnishment or a mistake that leads to a punitive audit, let our team get your payroll done right. Our Florida payroll services professionals have experience deducting appropriate taxes and garnishments from employee paychecks.

Examples of such taxes include:

- Social Security tax

- Federal taxes

- Unemployment taxes

- Medicare tax

The beauty of outsourcing payroll to proven professionals is the guarantee that every employee will be properly compensated for their contributions in full compliance with employment law. Moreover, our team understands the subtleties of state and federal employment rules and regulations.

As an example, Florida businesses with 10 or more employees are required to file Form RT-6, the Employer Quarterly Report, on a quarterly basis with the Florida Department of Revenue.

As a business owner, you have little free time and plenty of responsibilities. It doesn’t make sense to memorize and attempt to comply with the subtleties of payroll tax laws and other rules when our payroll professionals have a thorough understanding of those issues.

Florida employment law is laden with complexities, such as disability insurance rules. Unlike some other states, Florida does not require state disability insurance to be deducted from wages.

Instead of winging it with an in-house payroll administrator, outsource the work to our experts, who understand exactly what catches the attention of the Florida Department of Revenue and the IRS. Keep in mind a single payroll mistake has the potential to trigger an audit of state tax returns, encompassing payroll tax and state income tax.

Our payroll specialists keep a finger on the pulse of state and federal employment regulations at all times. Both such regulations require the reporting of new additions, including rehires, to the state’s New Hire Reporting Center within 20 days of commencing work. This is just one example of the subtleties we focus on to save businesses like yours time and money through the prevention of fines.

Business Solution Plans

Simple

Refreshingly easy payroll so you can get back to what matters most.

- Full-service payroll across all 50 states

- Friendly, experienced payroll and HR support

- Customizable reports

- Flexible PTO policies, accruals, and tracking

- Employee access to payroll debit cards and pay day advances

- Employee document management

- Electronic employee self-onboarding, self-service, and lifetime accounts

- Access for your accountant

- Integrated with accounting and time tracking software

Plus

Better HR tools so you can create a

great place to work.

- Next-day direct deposit

- Time-off requests and approvals

- Workers’ comp and health benefit administration

- Online offer letters

- Customized employee onboarding tools

- E-signing of custom documents

- Secure document storage for employee data

- Employee surveys and engagement tools

- Employee Performance Reviews

- Employee directory and org chart

- Multiple admin permissions

Premium

Certified HR pros and resources so you don’t have to go it alone.

- Live, unlimited access to a team of certified HR professionals

Proactive compliance updates and law alerts

Expert review of your existing policies and documents

HR Resource Center

Employee Handbook Builder

HR Fitness Test

Job Description Index

Searchable library of HR Policies, templates,and resources

On-demand video trainings

Say Goodbye to Payroll Hassles

Answer a few questions, and we’ll help you find the perfect HR and payroll solution.

Accurate Paychecks Processed in Accordance With Employment Law

Most Florida business owners and managers have a surface-level understanding of state employment law. There are nuances in Florida employment law regarding hourly wages, tipped hourly wages, and more. Complicating matters is the fact that employment laws governing hourly wage minimums are dynamic, meaning they change as new lawmakers take office.

As an example, some Florida business owners are unaware that the state’s minimum wage is poised to gradually increase, jumping all the way to $15 by 2026. The state’s minimum wage is currently $12 per hour. Wage increases will occur incrementally, meaning every business in the Sunshine State must comply with those increases or face financial penalties.

Here’s the breakdown of how Florida’s minimum wage will change in the years ahead. The state’s minimum wage will move up by a dollar per hour in sequential years. The bare minimum a Florida worker can be paid in 2024 is $13 per hour. The statewide minimum wage for the following year will be a minimum of $14 per hour.

Moreover, there is the potential for the statewide minimum wage to soar higher than $15 in 2027 and beyond. Instead of attempting to keep track of all the laws pertaining to Florida employment and compensation, let our payroll processors do the work for you.

America’s Preferred Payroll Serves all Florida Businesses

Let us handle your payroll, benefits administration, and more. Our Florida payroll services extend all the way to time, attendance, and compliance with employment law. We serve companies big and small, spanning all industries.

Call us today to learn more about how we can help your Florida business. You can reach our team by phone at (813) 865-4205 or by email at info@americaspreferredpayroll.com to learn more about how we help businesses like yours.

If you prefer to reach us through our website, fill out our contact form, and we’ll be in touch at our earliest convenience.