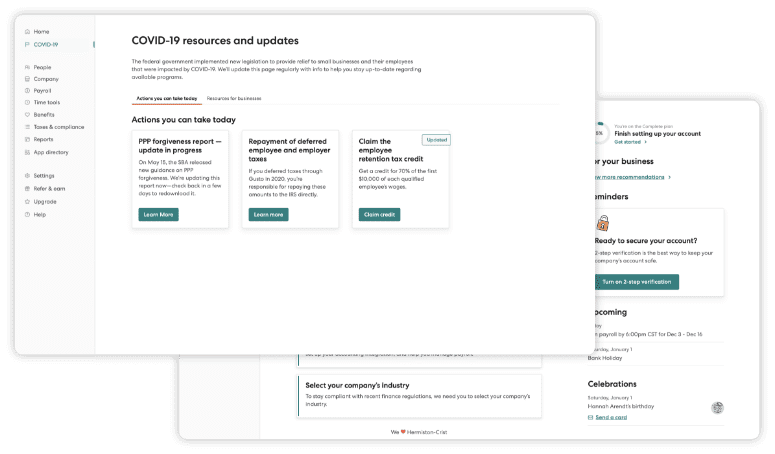

Online Dashboard

Stress-Free Payroll and Benefits Services for Construction

Why should construction companies and contractors work with America’s Preferred Payroll Company? Payroll and employee benefit services for construction companies and contractors differ from similar services in other industries. Construction companies need a knowledgeable and reliable construction payroll service for handling everything from payroll and deductions to government compliance and union rules.

Located in Central Florida, we serve construction companies and contractors all around the state. Phone us at (813) 865-4205 or use our online form to request more information.

Payroll and Benefits Services for Construction and Contractors

Learn more about our comprehensive payroll services for big or small construction businesses and why we offer the most efficient solution. First, consider some highlights of our services:

- Customer support: We have support representatives to answer the phone during business hours on Monday through Friday.

- Payroll for company employees and independent contractors: We process new direct deposits in 48 hours and accept timesheets 72 hours before scheduled pay.

- Flexible, informative payment options: Paid personnel can opt into two payment accounts, including savings, checking, and investments. Online paystubs make all payment details transparent.

- Custom reports for employers: Employers can gather insights from detailed reports of wages, vacation, sick time, taxes, total expenses, and much more. Quickly generate customized reports to suit various requirements.

- Construction-specific processing: With our payroll solution, we can handle certified payroll, union or new-hire reporting, Workers’ Compensation. If you don’t see the service listed here, ask.

We can handle various types of payrolls, including salaried and hourly workers. Our service includes overtime, vacation, holiday, paid time off, sick pay, and shift differentials. For bonuses or commissions, we can calculate reduced withholding rates. Our system easily services tips, cash advances, and reimbursements for expenses.

We Integrate with 1,100+ Popular Softwares

America’s Preferred Payroll dashboard connects with today’s top software.

Payroll Deductions

We also accurately process and distribute all deductions. These include pretax or taxable deductions for various medical benefits, FSAs, and HSAs, plus life insurance, retirement contributions, disability insurance, dependent care, loan repayments, child support, and required garnishments.

Integrations With Financial Software

We save our clients time by ensuring integration with such accounting software as QuickBooks, Peachtree, ATX, TaxWise, CCH ProSystem, and Microsoft Money. Clients also find it easy to produce exports to Microsoft Excel spreadsheets.

Tax Payments and Reports

We relieve worries over complex tax compliance by deducting taxes and filing on-time tax payments and forms to federal, state, and local authorities. Forms include 940, 941, W-2, and 1099 forms for contractors.

You keep funds as long as possible without any tax impounding because we pay when taxes come due and not before. Our No-Penalty-Guarantee means we stand behind the accuracy and timeliness of our work by offering to pay any penalties and interest for errors.

Service Plan

-

- Full-service payroll across all 50 states

- Friendly, experienced payroll support

- Customizable reports

- Flexible PTO policies, accruals, and tracking

- Employee access to payroll debit cards and payday advances

- Employee document management

- Electronic employee self-onboarding, self-service, and lifetime accounts

- Access for your accountant

- Integrated with accounting and time tracking software

Say Goodbye to Payroll Hassles

Answer a few questions, and we’ll help you find the perfect payroll solution.

Our Construction Payroll Services Vs. General Payroll Services

Some general kinds of businesses may prosper with one-size-fits-all payroll services. In our experience, most general payroll service providers lack the expertise or ability to handle the complexities of construction payroll, reporting, and compliance. We can work with various pay rates, jobs, building trades, tax jurisdictions, and regulations.

Our Payroll Services Vs. In-House Payroll Departments

Surveys have found that many small to mid-sized companies spend about forty percent of their administrative time just on payroll services. That barely considers time spent keeping up with changes in rules and regulations and a rapidly changing workforce.

Plus, in-house payroll departments cost additional overhead in the form of software, offices, and of course, employee pay and benefits for in-house employees. Our clients thrive because they spend less time worrying about payroll and more time focusing on construction.

What Kinds of Construction Clients Do We Serve?

Here at America’s Preferred Payroll, we serve construction clients through the State of Florida. Clients include contractors for all building trades. We work with all businesses, from contracting firms with a few employees to large construction companies that deploy thousands of workers to various locations, including non-union, union, government contractors, and more.

Experience a Better Payroll Processing Solution

Save time, gain better insights, and even please employees and independent contractors with a smooth, fast, and error-free payroll experience. Gain confidence by knowing that you’ve taken on a knowledgeable and reliable partner to answer questions, process payroll efficiently, and reduce your administrative burden.

Tell us about your construction business by calling (813) 865-4205 or using one of our handy online forms. We’ll explain how we can take the stress out of processing payroll for your construction company.