Say Goodbye to Payroll Hassles

Answer a few questions, and we’ll provide you with experienced payroll solution.

We Work with 1,100+ Popular Softwares

![]()

Personal Service Guarantee

Each business account is assigned an experienced account manager to walk you through everything you will need to seamlessly transition your business to it’s new payroll and corporate services so you can get back to focusing on what’s important.

Service Plan

- Full-service payroll across all 50 states

- Friendly, experienced payroll support

- Customizable reports

- Flexible PTO policies, accruals, and tracking

- Employee access to payroll debit cards and payday advances

- Employee document management

- Electronic employee self-onboarding, self-service, and lifetime accounts

- Access for your accountant

- Integrated with accounting and time tracking software

“Amazing customer service. Knowledgeable team. With all the concerns of running a successful small business, we never worry about our payroll. We highly recommend!

Edgar Gagnier

Owner & CEO, Tampa Company Inc.

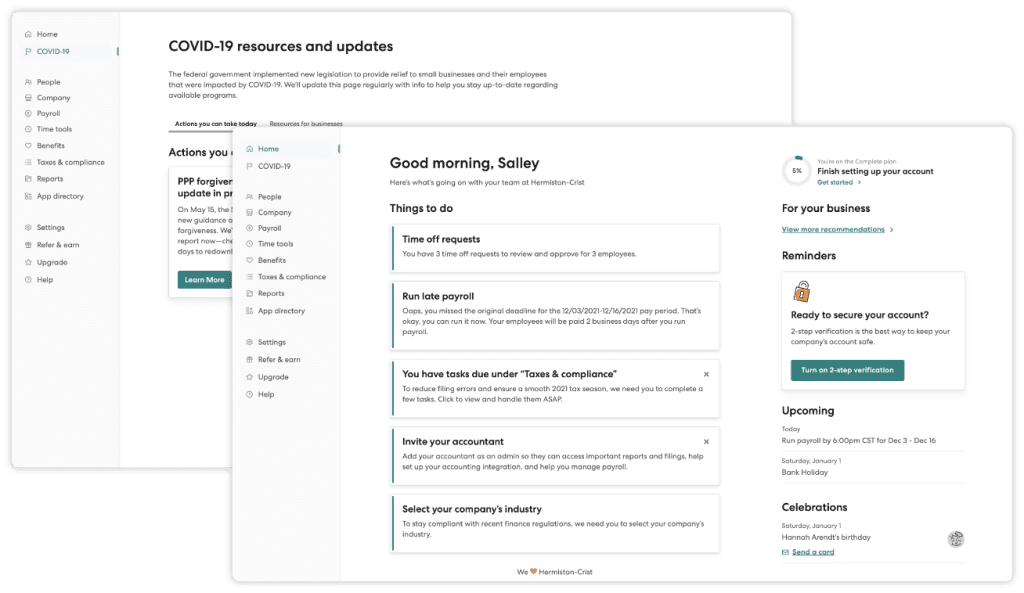

Payroll Dashboard

Corporate Solutions

Payroll Services

Workmans Comp

Payroll Tax Filing

Group Benefits

Health Insurance

Hiring & Onboarding

Direct Deposit Services

Time Keeping

Say Goodbye to Payroll Hassles

Answer a few questions, and we’ll help you find the perfect payroll solution.