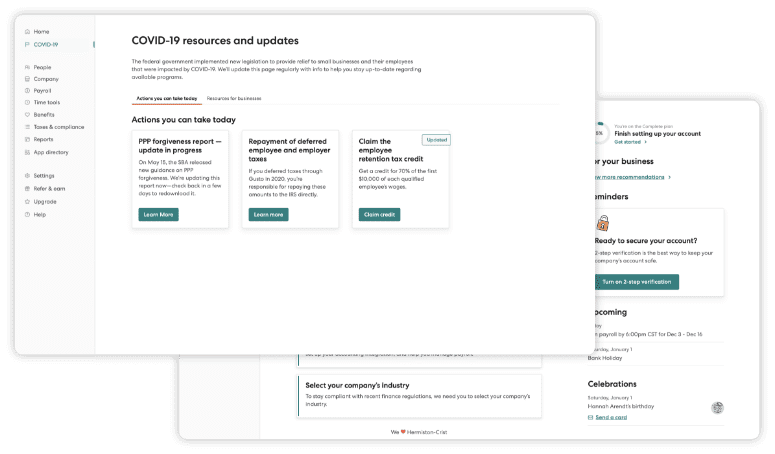

Online Dashboard

Restaurant owners and managers have enough on their plate with the responsibilities of daily operations. Worrying about processing payroll is the last thing that should be on a restaurant owner’s mind. Letting the payroll experts handle the subtleties of employee compensation, taxes, withholdings and other details related to employee compensation is clearly better than attempting to piece together the puzzle on your own.

Outsource your restaurant, bar, club or other venue’s payroll to our team and you will feel as though a weight has been lifted off your shoulders. We handle every aspect of payroll on your behalf to ensure your work crew is paid exactly what they are owed on time and in full.

Remove the Hassle of Restaurant Payroll

If you have processed payroll on your own or attempted to troubleshoot problems that arise during payroll processing, you know this weekly project has the potential to be a nightmare. This is precisely why most in-house employees dread the responsibility of payroll processing. Instead of burdening your team with this weekly challenge, liberate them to focus on what they do best by having our payroll experts process employee payments and related transactions on your behalf.

We pay attention to every last detail of taxes, withholdings, retirement contributions, child support payments, overtime wages, and more to get everything exactly right for your payroll. Even subtleties such as tip allocation amongst employees, how tips relate to minimum wage, employee classification as exempt or non-exempt, and overtime wage eligibility matter a great deal in the context of restaurant payroll. Do not let the issue of tips cause confusion, delays or inaccuracies in payroll processing. Let the experts process your payroll to perfection right down to the last penny and you won’t have any complaints from staff members about their compensation or the time necessary to process direct deposits or cut traditional paper checks.

While many other payroll processors refuse to customize service for the specific needs of restaurant owners and managers, we go out of our way to do so, providing flexibility for fully personalized payroll service that is absolutely perfect for businesses in this competitive industry. Even if your payroll is particularly complex due to tip pooling, a slew of part-time workers, child support payment obligations, and other wrinkles, our team is up for the challenge.

We Integrate with 1,100+ Popular Softwares

America’s Preferred Payroll dashboard connects with today’s top software.

Payroll With Your Unique Restaurant in Mind

No two restaurants are exactly the same. If you would like your payroll processed once per week or twice per week, let us know. Perhaps you have additional payroll requirements, preferences, or other customizations in mind. Meet with our payroll gurus and we will tailor our payroll service specifically to the needs of your unique restaurant, bar, club, or other business. We are well aware of the fact that restaurants have unique challenges and payroll nuances such as the employment of seasonal labor during the summer months and other busy times of the year, comparably high employee turnover, a large rotation of employees due to part-time scheduling, and more. Instead of providing cookie-cutter payroll service that is “one size fits all” for all restaurants and other businesses as occurs with other payroll companies, we take the time necessary to shape our service to the demands of your restaurant.

Service Plan

- Full-service payroll across all 50 states

- Friendly, experienced payroll support

- Customizable reports

- Flexible PTO policies, accruals, and tracking

- Employee access to payroll debit cards and payday advances

- Employee document management

- Electronic employee self-onboarding, self-service, and lifetime accounts

- Access for your accountant

- Integrated with accounting and time tracking software

Say Goodbye to Payroll Hassles

Answer a few questions, and we’ll help you find the perfect payroll solution.

Analysis Tailored to Your Unique Restaurant

Instead of simply processing payroll so employees are paid in full and on time, we have taken the extra step of providing detailed analysis through helpful reports. These reports are generated with information plucked directly from your restaurant’s unique payroll information such as wages, salaries, taxes, sick time/vacation hours used, labor allocations, hours worked, and more. Check out your customized reports and you will agree the insights provided by this quantitative analysis have the potential to prove just as important to your bottom line as efficient payroll processing.